Six Functions of a $1

'Six Functions of a $1' is a suite of computational routines commonly used in finance,

economics, engineering, and real estate. In any circumstance where the time value of money

is a necessary consideration for investment or return on investment, these routines play a key

role in analysis and decision-making.

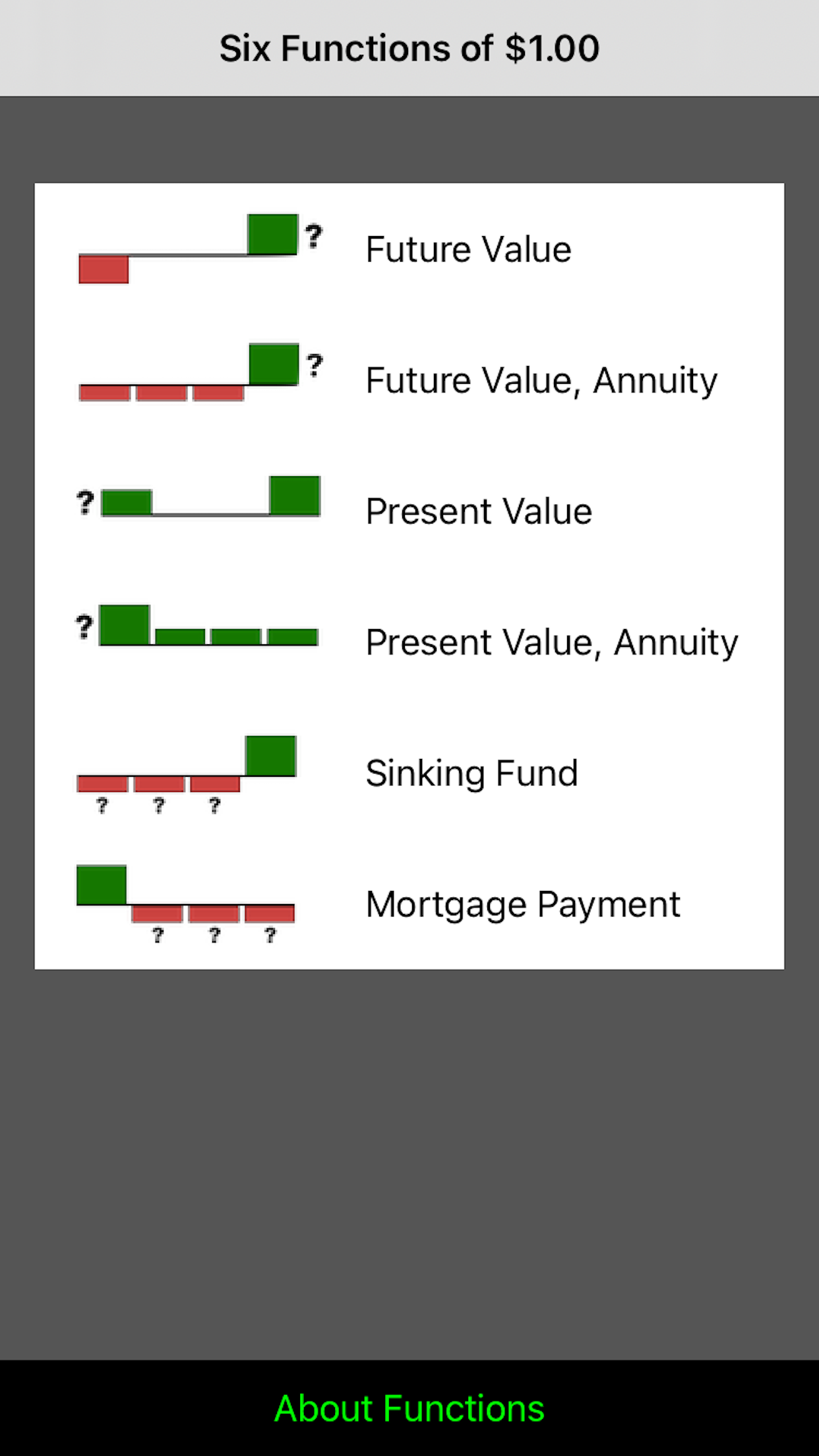

The six functions are:

- Future value

- Future value of an annuity

- Present value

- Present value of an annuity

- Sinking fund amount

- Mortgage payment amount

examples

Here are some real-world examples that highlight the use of each of the six functions:

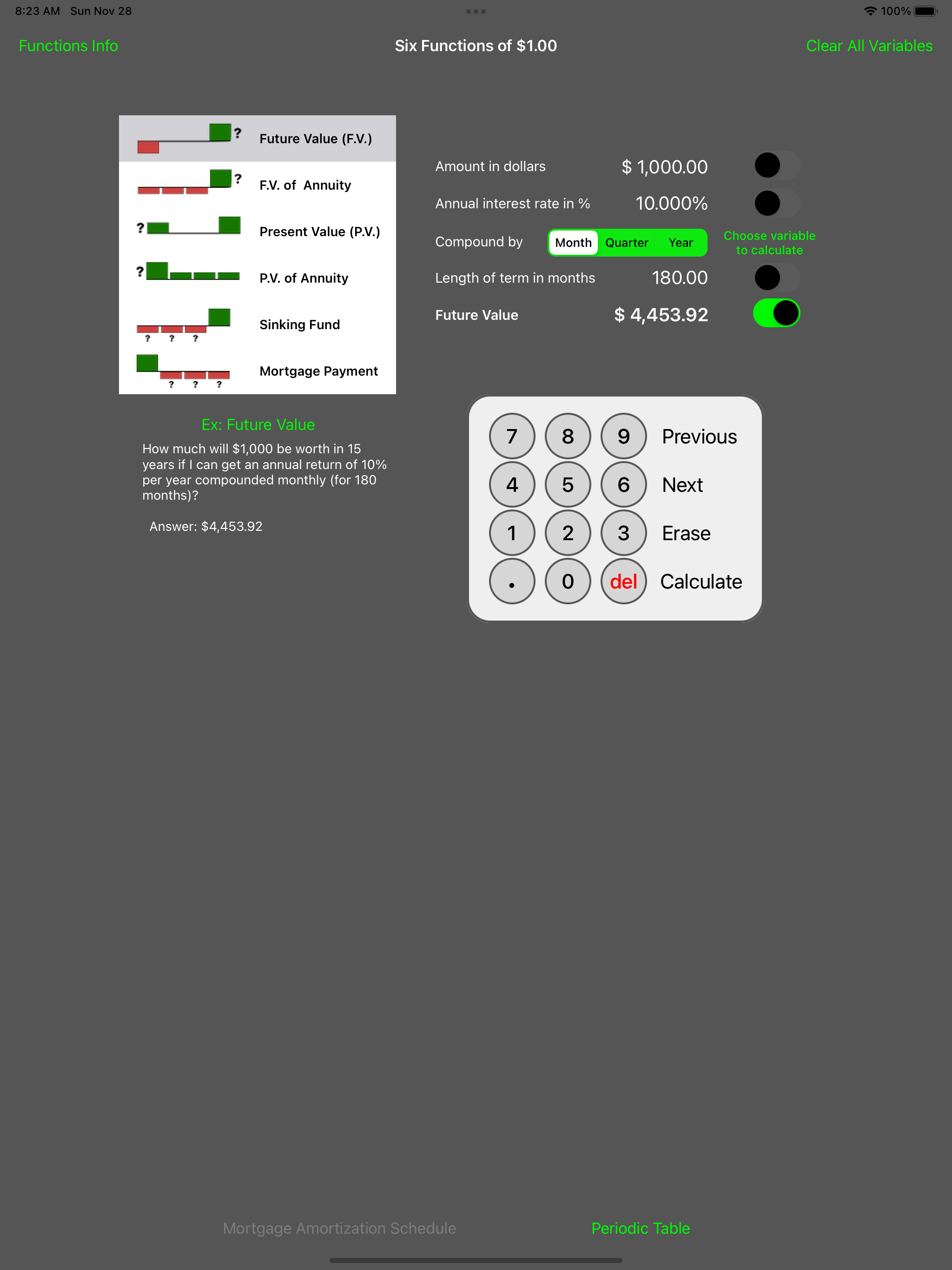

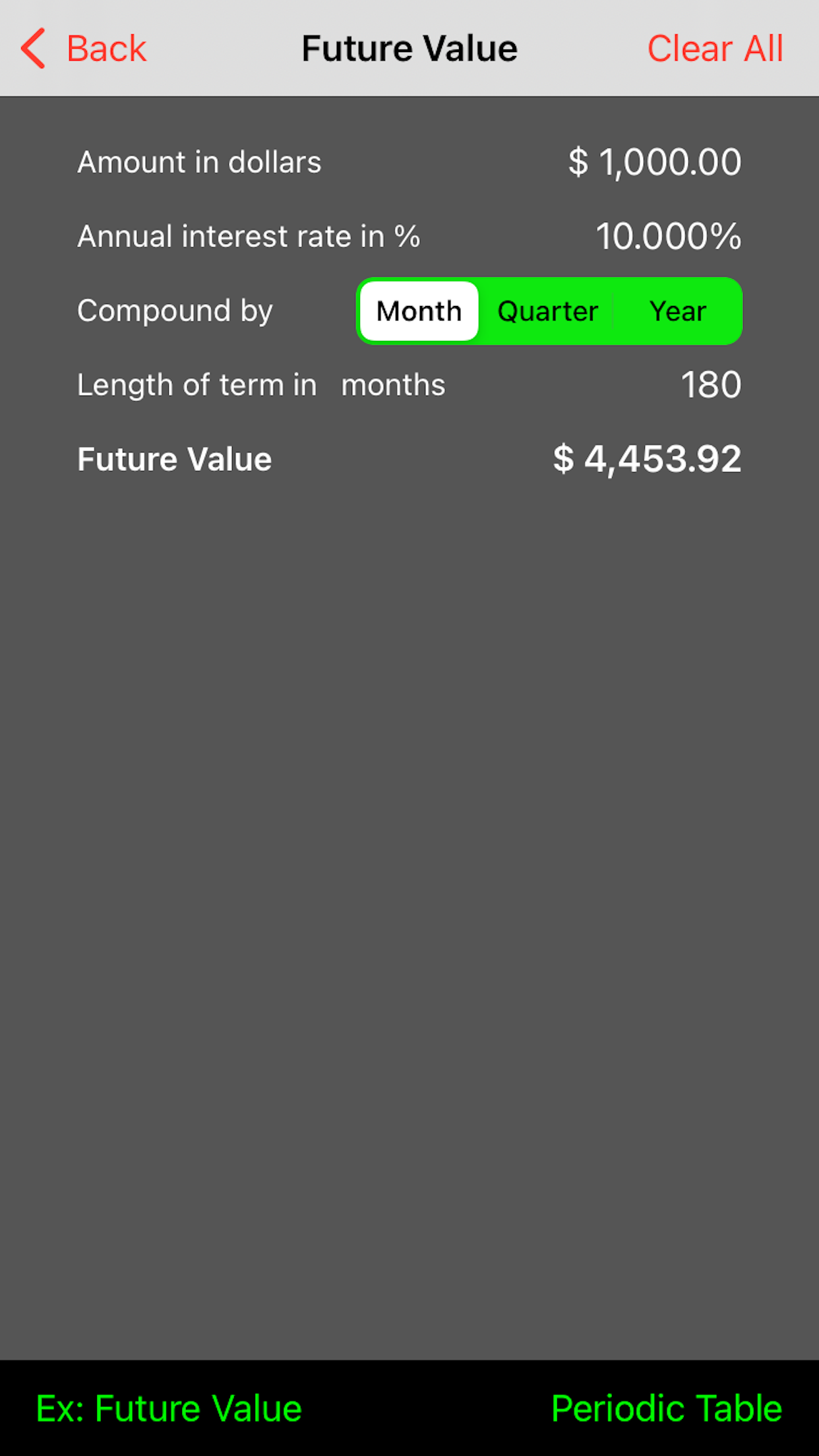

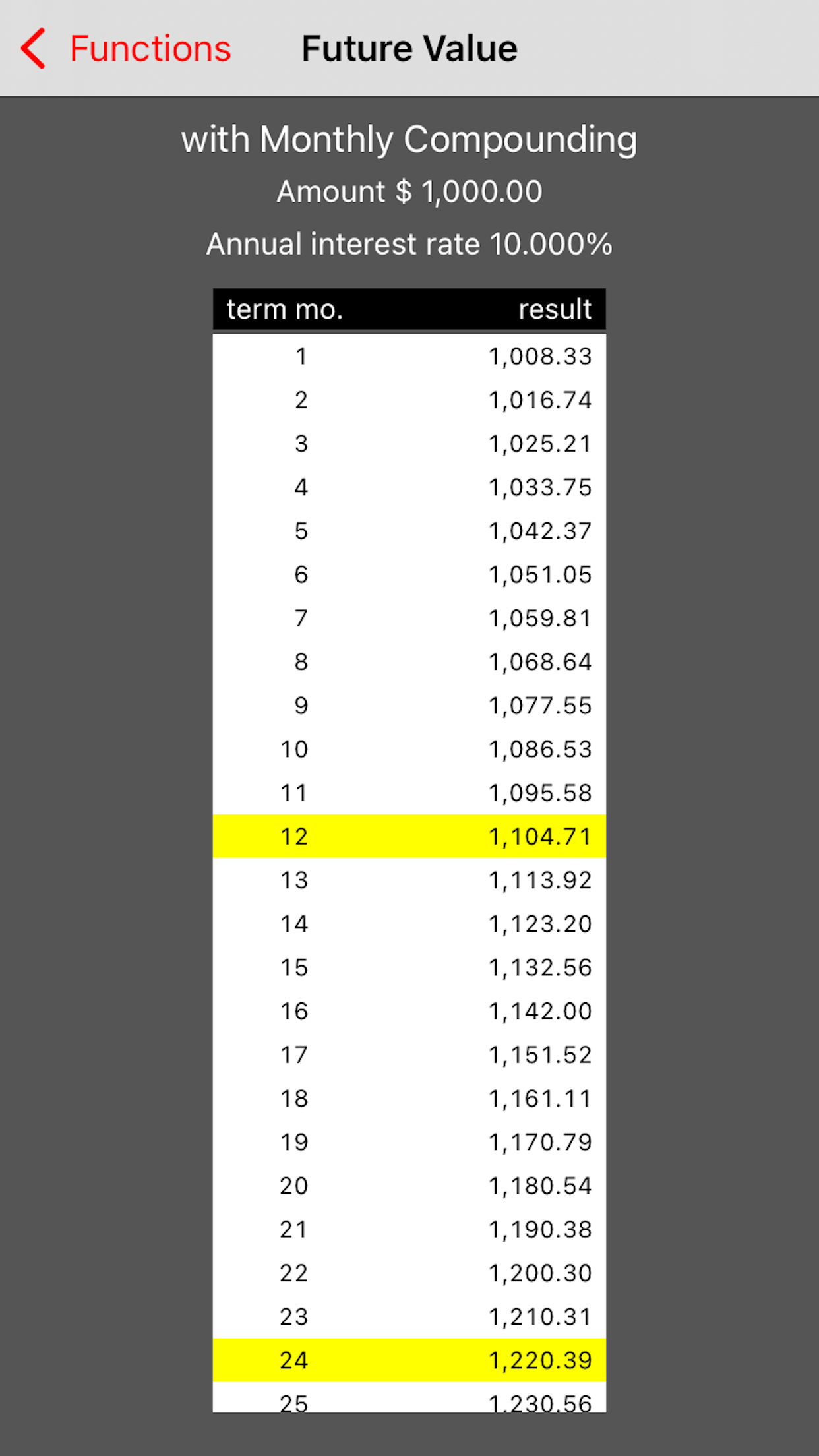

Future value:

How much will $1,000 be worth in 15 years if I can get an annual return of

10% per year compounded monthly (for 180 months)?

Answer: $4,453.92

Future value, annuity

I'd like to save for our daughter's college education by investing $5,000 a year

for the next 5 years. I can earn 6% per year on this annual annuity. How much will this plan

achieve?

Answer: $28,185.46

Present value:

I have a chance to purchase an investment that will not produce annual returns

but will return $50,000 to me in 10 years. The seller is driving a hard bargain, but the

investment has relatively little risk. Thus, I will apply a discount rate of just 3.5% per

annum compounded monthly for this opportunity. With these assumptions, what is the maximum

amount I should invest in this opportunity?

Answer: $35,252.36

Present value, annuity:

Our daughter's grandparents are planning to put $25 per month into an existing

college fund. The fund is expected to earn 4.375% per year over the next 15 years (180 months).

Rather than contributing on a monthly basis, her grandparents are able to make a lump sum

contribution today. How much would that lump sum contribution be to produce the same

investment objective?

Answer: $3,295.46

Sinking fund:

I own a small industrial building that has an old HVAC system that I expect

to replace in 5 years at a cost of $5,000. In order to pay for the replacement, I want to

set aside a small amount of money each quarter (20 total quarters) rather than pay the full

amount later. A lender will pay me 8% per annum on the quarterly annuity investment.

What is that quarterly amount?

Answer: $205.78

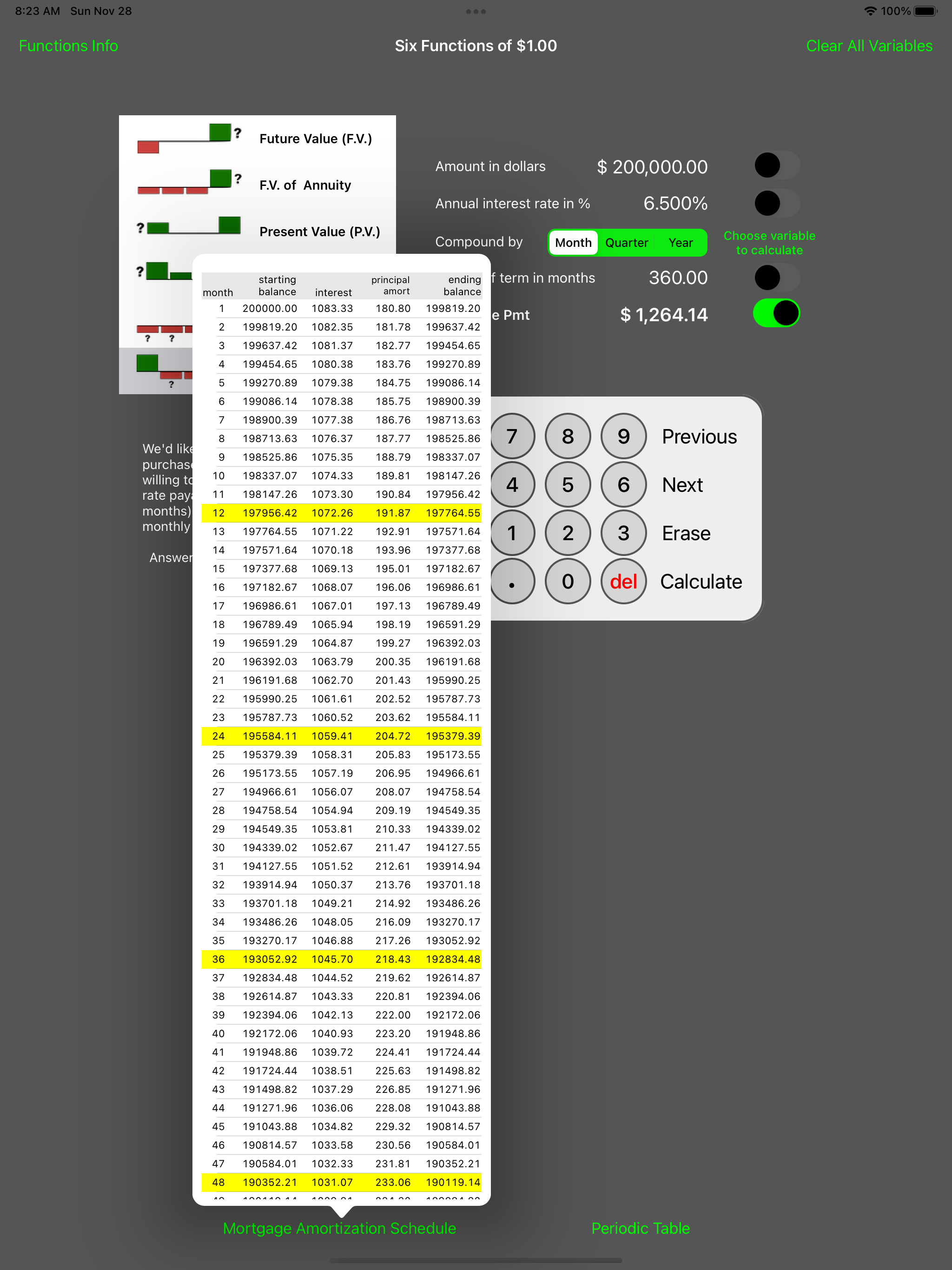

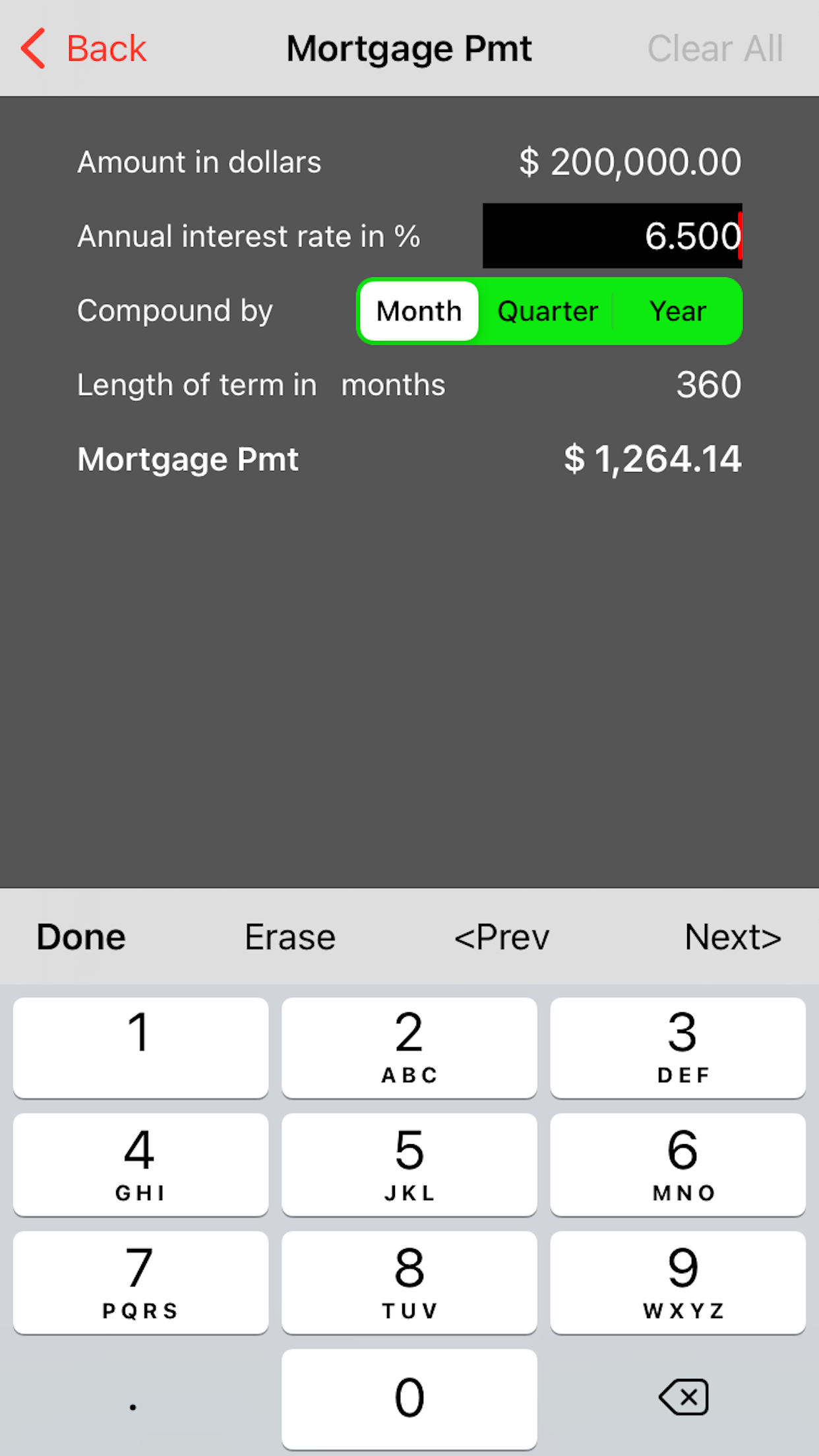

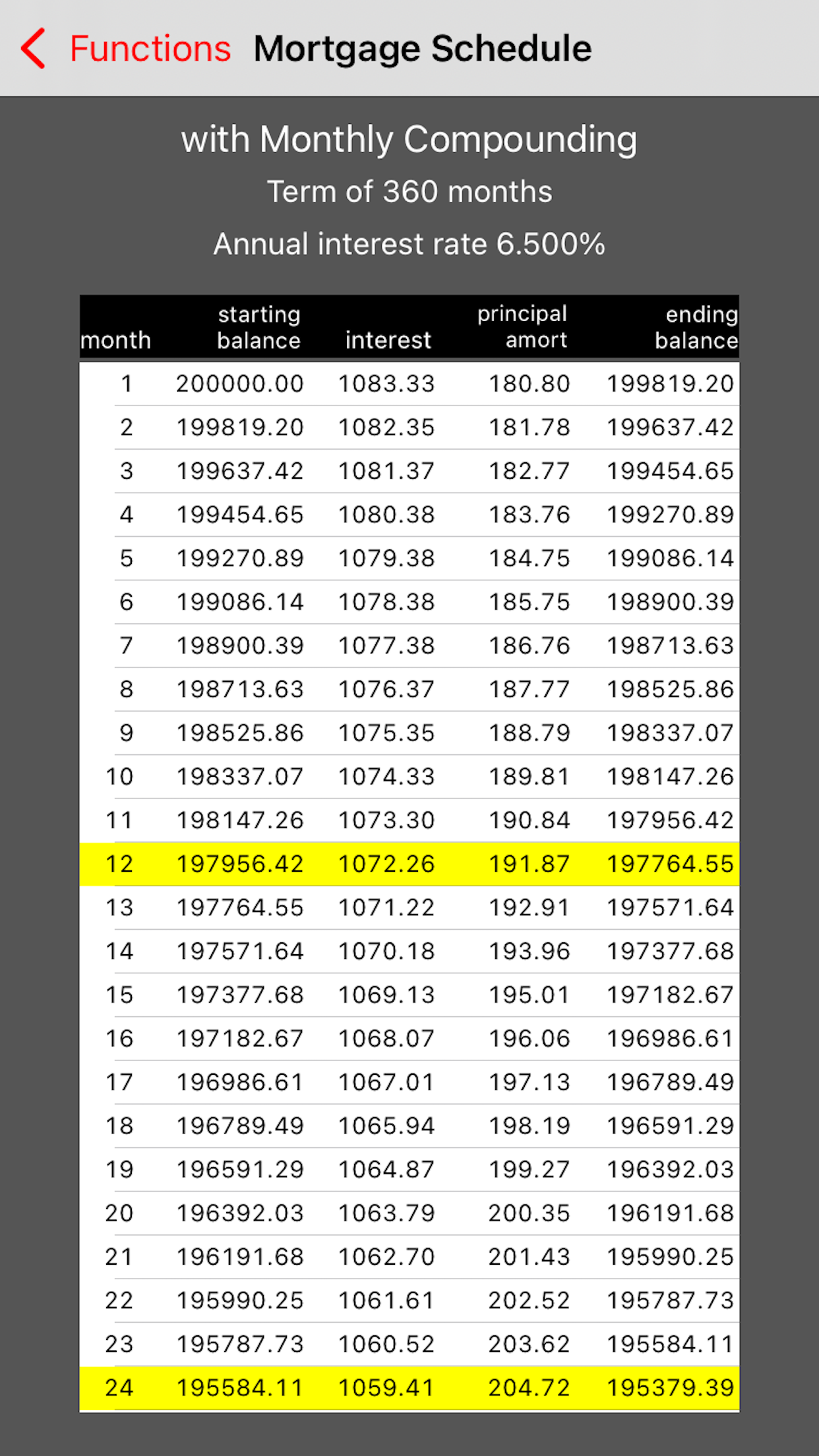

Mortgage payment:

We'd like to get a $200,000 mortgage to purchase a new home. Our lender is

willing to lend at a 6.5% annual interest rate payable monthly for 30 years (360 months).

On these terms, what will be our monthly mortgage payment?

Answer: $1,264.14

|