MPT Efficient Frontier for Portfolio Optimization

Modern Portfolio Theory (MPT) recognizes that investment returns also carry risks.

When assembling a portfolio of risky assets, it is necessary to account for these

two components as well as the correlation among the assets.

When risky assets are combined in a portfolio, the expected return of the

portfolio, E(Rp) is the weighted average of the returns for each asset. If the

asset returns are not perfectly correlated, the expected risk of the portfolio is

somewhat more complicated. By convention, standard deviation, the square root of

the variance, is a proxy for asset risk.

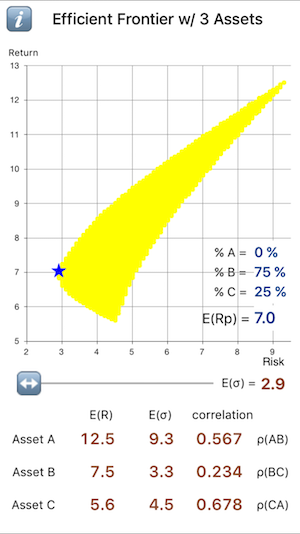

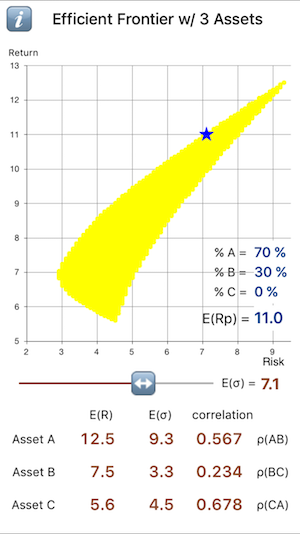

The Efficient Frontier plots in risk-expected return space every possible

combination of assets A, B, and C. The upper edge of the curve represents

each outcome for which the portfolio return is maximized for a given level of portfolio risk.

The ‘blue star’ shows the return along the efficient frontier at the risk level

selected by the slider. Additionally, the shares of assets A, B, and C for the

portfolio that produced this point are displayed to the right of the graph.

|